Mapping Price Zones

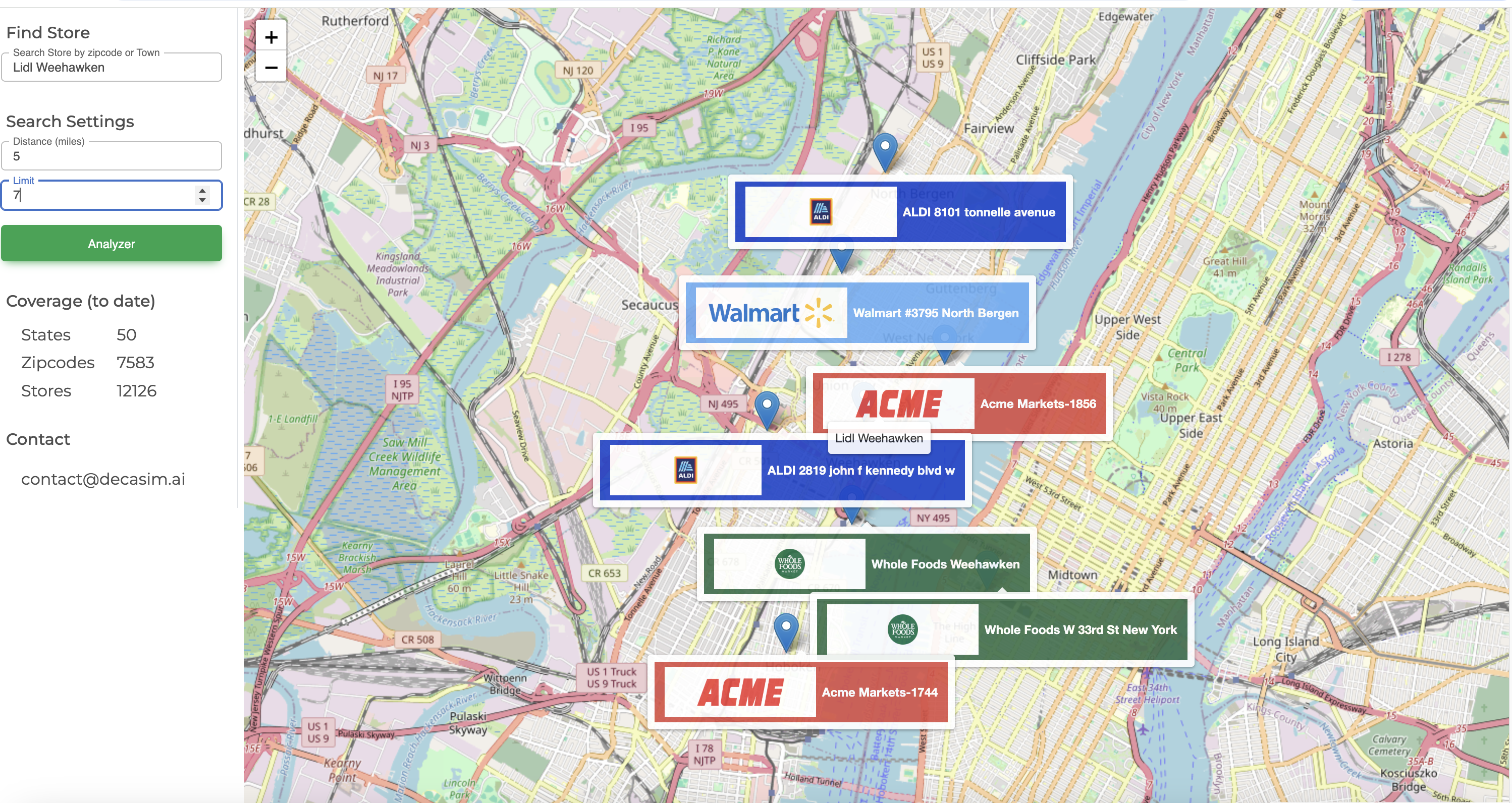

Now that we have begun to extract and process publicly available promotion data we can also create maps of price zones. Understanding where your stores overlap with your competitors' price zones is a powerful tool.

Now that we have begun to extract and process publicly available promotion data we can also create maps of price zones. Understanding where your stores overlap with your competitors' price zones is a powerful tool.

This week we have taken a different approach. Moving into the Mid West region to see how the Albertson's Inc banner Jewel Osco performs against some local retailers alongside Aldi.

We have selected zip code 60618 in Chicago. The median household income of this zip code is $101,558 and the total population is 90,316 according to the latest census data.

Analysis of this zip code shows 4 distinct retail banners. Jewel Osco has approximately 40 stores, Aldi has over 2000 stores across the USA whereas Cermak Fresh Market and Tony's Fresh Market are much smaller with 17 and 19 stores, respectively.

In the highly competitive U.S. grocery retail industry, valued at $883.1 billion in 2025, price promotions remain a cornerstone of retail strategy, IBISWorld, 2025[^1]. Research demonstrates that price promotions are one of the most effective tactics for supermarkets to improve performance, though their impact varies significantly across product categories and store formats, Journal of Revenue and Pricing Management[^2].

This week we have selected another competitive zip code, again in the mid-Atlantic region. As we add more retail locations to our map, we are on the lookout for competitive markets. We define a competitive market as one which has a high number of unique banners in the zip code area.

Analysis of Annapolis, MD shows 6 retail banners in the zip code.

For the past month we have been revamping our Compete product. The aim of the product is to provide retailer category managers and CPG brand managers a view of the competitive landscape from the perspective of the shopper.

This week is one of the important weeks in grocery retail. For food retailers, Easter usually means family gatherings which means there are more mouths to feed. Consequently, this means bigger baskets, so it is important to win in these weeks.

We stayed in Towson MD for this week's analysis and have included the same set of banners from last week, with the exception of Eddies, who had not published their weekly circular at the time of analysis.

Before we get into the analysis of who won the week it's worth looking at the strategies that different retailers employ for promotional planning. One of the big decisions is what day is the start of your promotional week. A lot of retailers opt for Wednesday, it means hanging price tags on Tuesday evening which is usually a quiet day in retail. What's interesting in this group of banners is that the majority of them start their promotional week on a Friday.

This data adds support that Giant Food and Safeway are locked in a promotional fight each week. Interestingly, my local Safeway (on the West coast) runs a Wednesday-Tuesday promotional week, so someone in Safeway's HQ has decided to split the promo planning process in two. Weis Markets, a smaller operator, are trying to get the jump on the price conscious shopper/ cherry picker by running Thursday-Wednesday promotional week, a solid flanking move if you don't have the promo budgets of your competitors.

Every week, in the headquarters of grocery supermarkets across the country, the chief merchants and category managers will get together to see who "won the week". How the winner is determined is only part data-driven, relying on a combination of factors; depth of discount vs quality of item. What's missing from this calculation is customer behavior.

In this regular series of blog posts we are going to rectify that by putting our grocery AI model to the test and establish, through data, who won the week based on customer response to the combined set of offers from all[^*] retailers' promotions that week.

Reading some data from the USDA

For every 1 square-foot (SF) of restaurant space there is 0.47 SF of grocery retail space. For ever 6.3 Food Away From Home establishments there is one Food-At-Home establishment

| Segment | $Bn Sales | Establishments | Annual $mn / Estab. | Avg SF | $ / SF |

|---|---|---|---|---|---|

| Food Away From Home | $1,500 | 483,355 | $3.1 | 3K | 1000 |

| Food At Home | $1,100 | 77,021 | $14.3 | 40K | 356 |

Looking at the spend data on a per capita basis

| Segment | $Bn Sales | Popn. (mn) | Annual $ / Capita. |

|---|---|---|---|

| Food Away From Home | $1,500 | 340 | $4,411 |

| Food At Home | $1,100 | 340 | $3,235 |

Combining these stats a restaurant on average captures 100% share of wallet for Food away from home each year from ~700 people while a supermarket captures 100% of wallet from ~4400 people/year.

For an average family of 4 people, this is their breakdown of weekly spend on Food Away From Home vs Food At Home

| Segment | $ Weekly Spend |

|---|---|

| Food Away From Home | $339 |

| Food At Home | $248 |

Trader Joe's store size ranges from 10,000 SF to 15,000 SF while a Kroger Market Place stores occupy approx 145,000 SF

How do you grow a business? If you asked that question in an MBA college class, you’d get a varied set of answers, but themes would emerge: have a strategy, control costs, know your customer, a unique product/service, execute the plan. None of these answers are wrong, but MBA students’ answers miss the point: the real world is imperfect with neither the time, resources nor budgets to tackle the issue of growth from an academic standpoint. Shareholders want value…now. Customers want the product/service…now. Employees want to be taken care of…now. In established businesses, a growth strategy generally involves changing an existing course of action. What exists may be well known and preferred, and change is generally seen as something which is painful, risky and undesirable.

Which explains why many businesses eke out incremental growth year after year. So, let’s address some of the macro questions associated with growth and strategy.